Many banks and businesses are ready to accept Apple Pay.

Yes, I know – Android did it first.

NFC technology is nothing new and has been integrated into mobile phones since the mid-2000s. And while Google Wallet has been making it easier to transfer money for over three years; the notion of using NFC to pay for things hasn’t really caught on.

It wasn’t until Apple announced they would be adding NFC technology to the iPhone 6 that most people started noticing. I don’t think it will happen overnight – or even in a few years – but I foresee a future where Apple Pay (and other NFC technologies) is the preferred method of handling funds.

Here Are Five Reasons Why Apple Pay Will Be a Success:

1. Everyone Will Eventually Own a Smartphone

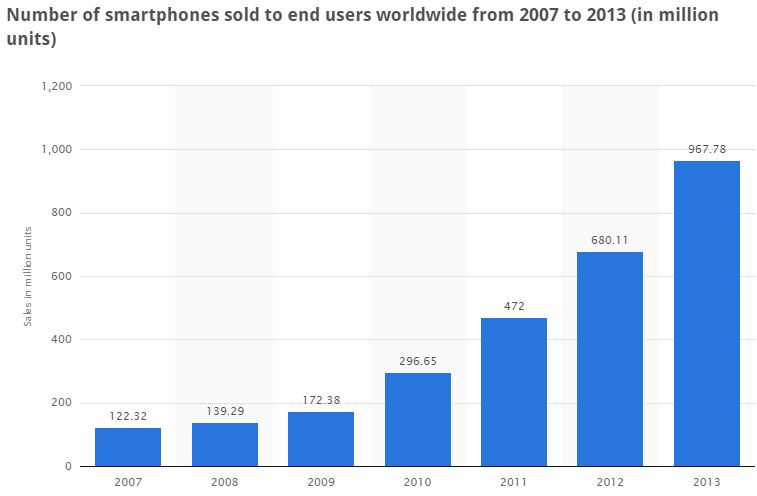

In just six years, the number of smartphones sold around the world increased sevenfold. Over 967 million units were purchased last year alone and it wouldn’t be a huge surprise if that number reaches 1 billion by the end of 2014. Most of these smartphones are running the Android operating system — making it likely NFC and Google Wallet will be accessible by millions of people.

2. Most Americans Use iPhones

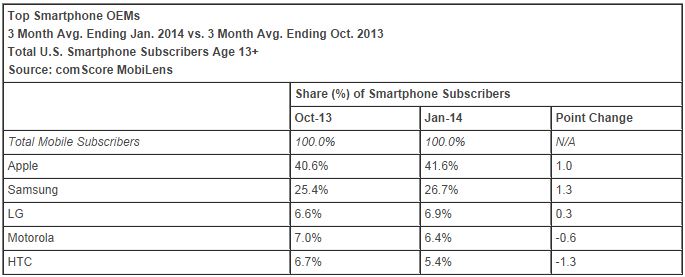

Google may own 51.7% of the mobile operating system market share in North America, but the iPhone is still the most popular smartphone. Apple has a whopping 41.6% stranglehold on U.S. smartphone subscribers and the closest competition (Samsung) is far behind with only 26.7%. And because Apple is headquartered in the U.S.A., you can be sure Apple Pay will be accepted in many places.

3. Hacking Smartphones Isn’t as Easy as You Think

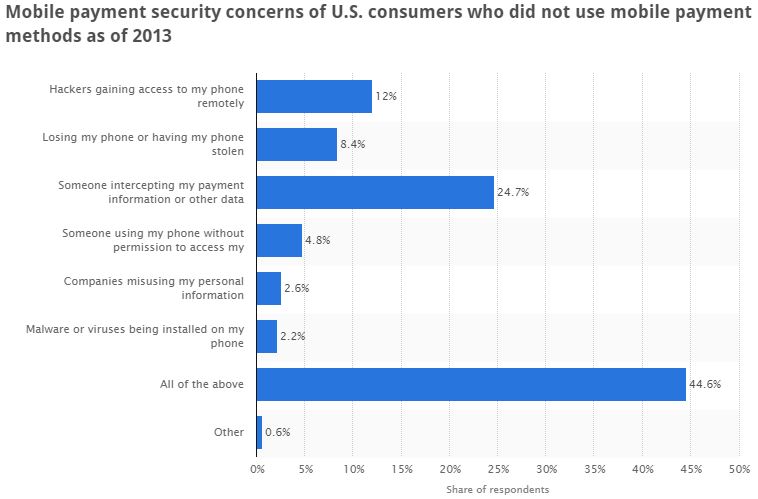

Many people are skeptical about transferring money through NFC because of security reasons. And recent reports of celebrities getting their iPhone’s hacked only solidifies this belief. However, these iPhone users were specifically targeted, and access to their data was achieved by simply guessing their password. In reality, modern smartphones are so secure even the FBI thinks they should be made easier to hack.

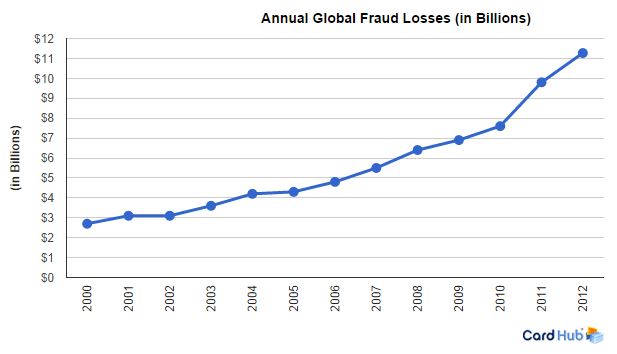

4. NFC is More Convenient and Secure Than Debit Cards

Because more retailers are getting hacked and having their debit and credit card information stolen, consumers need a safer alternative. Apple’s approach to NFC payments increases security because it never uses your debit or credit card information. Instead, a physical chip inside the iPhone 6 generates a one-time code and hackers will never have access to your banking information.

5. Even the Competition Thinks Apple Pay is a Good Idea

“Well, Apple Pay’s a great example of how a cell phone that identifies its user in a pretty strong way lets you make a transaction that should be very, very inexpensive. So the fact that in any application I can buy something, that’s fantastic. The fact I don’t need a physical card anymore, I just do that transaction and you’re going to be quite sure about who it is on the other end, that is a real contribution. And all the platforms, whether it’s Apple’s or Google’s or Microsoft, you’ll see this payment capability get built in. That’s built on industry standard protocols, NFC. And these companies have all participated in getting those going. Apple will help make sure it gets to critical mass for all the devices.”

— Bill Gates

Looking Forward

There’s no way of predicting how long it will take for Apple Pay to succeed. But if the founder of Microsoft – a company which has been Apple’s biggest rival for three decades – believes Apple Pay will be a success, so do I.

Even if you don’t use an iPhone, the success of Apple Pay will make NFC payments in America the norm, and later the world. Tokenization is what sets Apple Pay apart from the competition and as more consumers use it, other smartphone manufacturers will follow suit.

The days of carrying a wallet that holds your banking information are numbered. Don’t believe me? Just take a look at the features below and tell me Apple Pay is not more convenient than how you’re paying for stuff now.

Apple Pay Features

- One touch to pay with Touch ID.

- Now paying in stores happens in one natural motion — there’s no need to open an app or even wake your display thanks to the innovative Near Field Communication antenna in iPhone 6. To pay, just hold your iPhone near the contactless reader with your finger on Touch ID. You don’t even have to look at the screen to know your payment information was successfully sent. A subtle vibration and beep lets you know.

- Convenient checkout.

- On iPhone, you can also use Apple Pay to pay with a single touch in apps. Checking out is as easy as selecting “Apple Pay” and placing your finger on the Touch ID.

- Setup is simple.

- Passbook already stores your boarding passes, tickets, coupons, and more. Now it can store your credit and debit cards, too. To get started, you can add the credit or debit card from your iTunes account to Passbook by simply entering the card security code. To add a new card on iPhone, use your iSight camera to instantly capture your card information. Or simply type it in manually. The first card you add automatically becomes your default payment card, but you can go to Passbook anytime to pay with a different card or select a new default in Settings.

- Protect your accounts. Even if you lose your device.

- If your iPhone is ever lost or stolen, you can use Find My iPhone to quickly put your device in Lost Mode so nothing is accessible, or you can wipe your iPhone clean completely.

- Apple doesn’t save your transaction information.

- With Apple Pay, your payments are private. Apple doesn’t store the details of your transactions so they can’t be tied back to you. Your most recent purchases are kept in Passbook for your convenience, but that’s as far as it goes.

- Keep your cards in your wallet.

- Since you never have to show your credit or debit-card, you never reveal your name, card number, or security code to the cashier when you pay in a store. This additional layer of privacy helps ensure that your information stays where it belongs. With you.

- The major credit cards. With the same major benefits.

- Apple Pay works with most of the major credit and debit cards from the top U.S. banks. Just add your participating cards to Passbook and you’ll continue to get all the rewards, benefits, and security of your cards.

- Accepted at 220,000 stores. And counting.

- Apple Pay lets you use iPhone 6 to pay at over 220,000 locations accepting contactless payments and within participating apps. And there are even more stores and apps to come.

Do you think Apple Pay will succeed? Will NFC payments replace our debit and credit cards? Let us know in the comments below!