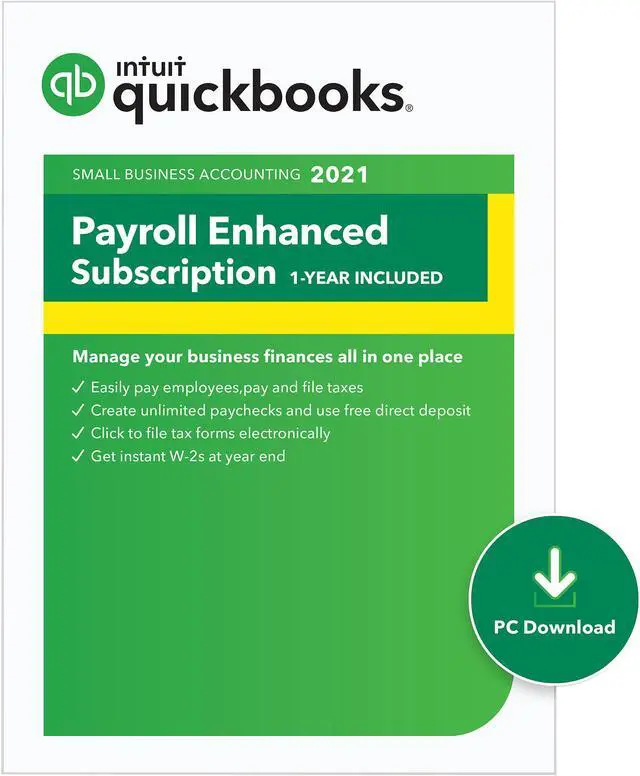

| Disclaimer | QuickBooks Payroll Enhanced requires a payroll subscription, Internet access, Federal Employer Identification Number (FEIN), supported version of QuickBooks Desktop Pro updated to the most current maintenance release, and valid debit/credit card on file for processing payroll. Not compatible with QuickBooks Online and Mac editions. Check stock sold separately. Plus sales tax where applicable. Includes 1 employee. Easily add more for a nominal monthly fee. See current pricing at payroll.intuit.com/desktop. QuickBooks Desktop Pro supports a maximum of 14,500 employees, customers, vendors and other names combined. However, performance may slow when processing files containing more than 250 employees. 24/7 access is subject to occasional downtime due to systems and servers maintenance. E-file and e-pay features are available for federal and select state taxes. Please check availability at quickbooks.com/payroll-compliance. You may need to register with tax agencies in order to use e-file and e-pay features. To create W-2s, active subscription required or additional fees may apply. You are responsible for printing W-2s for your employees and filing with the IRS. After the first year, your subscription will automatically renew each year at the then-current price for the offering you selected using the billing info we have on file at the time of your renewal, unless you cancel. Call us anytime at 1-800-4Intuit to cancel your payroll subscription. Terms and conditions, features, support, pricing, and service options subject to change without notice. |

|---|