Earlier this year, the Internal Revenue Service (IRS) issued a notice that declared “virtual currency is treated as property for U.S. federal tax purposes.” This declaration not only means that general tax principles apply to transactions involving virtual currency, but it also further cements the notion that a digital payment system is a credible method of transferring funds. As retailers (including Newegg.com) begin accepting virtual currency in exchange for goods, the question that is on many people’s mind is: “Is it ‘real’ money?”

Regardless of what your concept of “real” money is, the fact is that virtual currency is already operating as legal tender. It may not be in the shape of a coin or a piece of green paper, but virtual currency has been circulating as a medium of exchange since it rose to prominence around 2012. And even if you disagree with this concept, you can’t argue with the IRS.

Virtual Currency Tax Principles According to the IRS

- Wages paid to employees using virtual currency are taxable to the employee, must be reported by an employer on a Form W-2, and are subject to federal income tax withholding and payroll taxes.

- Payments using virtual currency made to independent contractors and other service providers are taxable and self-employment tax rules generally apply. Normally, payers must issue Form 1099.

- The character of gain or loss from the sale or exchange of virtual currency depends on whether the virtual currency is a capital asset in the hands of the taxpayer.

- A payment made using virtual currency is subject to information reporting to the same extent as any other payment made in property.

Many companies who have been holding out on accepting virtual currency have changed their mind solely because of the IRS’ guidelines. Among them is the Wikimedia Foundation, a non-profit organization that operates one of the world’s most popular websites, Wikipedia. They cite the requests of their donors and the guidance of the IRS as the determining factors in accepting Bitcoin donations and believe there is minimal risk involved in accepting virtual currency.

“The Wikimedia Foundation, as a donor-driven organization, has a fiduciary duty to be responsible and prudent with its money, while striving to provide as many methods of donating as possible. Our donors indicated that they were interested in supporting us through Bitcoin. After some investigation, we set up a method to accept Bitcoin donations.”

–The Wikimedia Foundation

Bitcoin is not the only virtual currency that’s available today but it is definitely the most popular. Created in 2009, Bitcoin is accepted by some of the world’s most popular merchants and is legal in 28 countries. Bitcoin has become so popular in one of these countries (Argentina), that citizens have begun using the virtual currency as an alternative to their official currency which is often hindered by inflation. And as more Argentinian retailers trade in their credit card machines to accept Bitcoin, some analysts believe the country may become the world’s first cashless society.

“We know the peso will lose value – and probably rapidly. With Bitcoin, even if it just maintains price, it’s a huge advantage for us Argentinians.”

– Franco Daniel Amati, Co-Founder of the Bitcoin Foundation of Argentina

Virtual currency does not have legal tender status in any jurisdiction, but it does have value in “real” currency. Anyone that owns virtual currency can exchange it for U.S. dollars, Euros, or any other currency they want – even another virtual currency. It’s the only digital representation of value that can function as a medium of exchange and has tax liability. So why are people so hesitant to call it “real” money?

The answer is twofold:

First, many people believe virtual currency is dangerous because it is not regulated by the government or backed by a precious metal. Unlike fiat or commodity money, virtual currency does not rely on any authorities (law) or physical properties (like gold and silver) to determine its value. Instead, virtual currency is backed by basic mathematics and its worth is solely dependent on supply and demand.

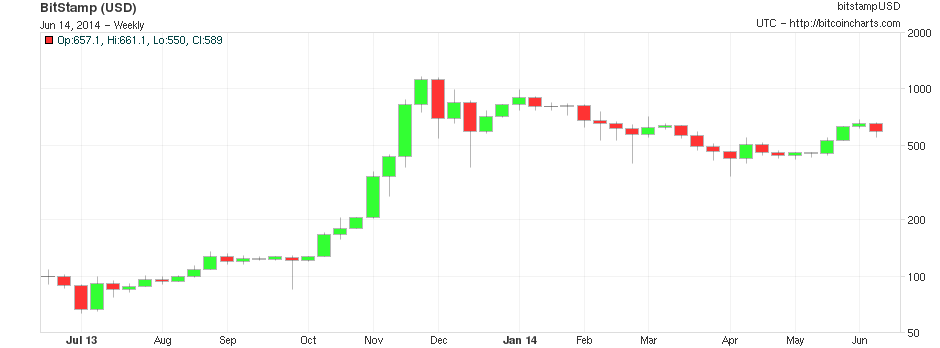

Second, because the value of virtual currency goes up and down as demand increases and decreases, its price is extremely volatile. Bitcoin, for example, fluctuated in price from nearly $1100 USD at the end of 2013 and is currently valued at $582 USD. This vulnerability scares many economists because virtual currency could potentially become worthless overnight.

The price of Bitcoin is constantly changing due to supply and demand.

Despite the unpredictability of virtual currency, its popularity is proof that it has the potential to replace traditional methods of payment. Bank accounts are already a bunch of ones and zeros on a computer and virtual currency is the first step in creating a globally-accepted network of money. Whether it’s Bitcoin or another virtual currency, something will eventually replace our debit cards – just like those debit cards replaced cash and cash replaced seashells.

I don’t know if virtual currency is the beginning of the end or the end of the beginning, but I do know that it’s “real.” Don’t believe me? Just ask the IRS.

Do you think virtual currency like Bitcoin will eventually replace fiat and commodity money? Is virtual currency “real” money?